Table of Contents

Understanding the Value of Co-op Fund Management

Co-op marketing funds are a key investment in channel marketing. These funds help channel partners run local marketing campaigns, boosting brand visibility and sales. When managed well, they create a win-win scenario by providing partners with financial support.

At the same time, businesses can extend their market reach without bearing the full cost. Effective co-op fund management ensures these funds are allocated and utilized efficiently for maximum impact.

Lately, there has been a shift in the co-op fund usage by brands and channel partners. Traditionally, co-op marketing funds have been heavily allocated to offline channels, with 80% funds directed towards non-digital mediums.

Additionally, Market Development Funds (MDF) and co-op funds are often confused, leading to mismanagement of resources. Co-op funds are typically earned based on sales performance. MDF, on the other hand, is provided at a brand’s discretion to support strategic growth initiatives like product launches or new market expansion. Understanding the difference between these funding types is crucial for effective fund utilization.

However, there’s a growing recognition of the benefits of digital co-op advertising, especially through Product Listing Ads (PLAs). This shift presents a substantial opportunity for both brands and partners to optimize their co-op fund allocation.

Many businesses struggle with co-op fund utilization. Billions of dollars go unspent each year due to complex guidelines, lack of awareness, and cumbersome reimbursement processes. Some partners avoid using co-op marketing funds altogether because they find the process confusing or time-consuming.

Effective co-op fund management directly impacts co-op marketing ROI. Proper allocation ensures funds are used for high-impact marketing activities. A structured program increases partner participation, improves fund utilization, and strengthens relationships.

With clear guidelines and tracking, businesses can measure performance and optimize future investments.

This guide will break down how to manage co-op funds efficiently. From allocation strategies to ROI optimization, you’ll learn how to turn co-op channel partner funding into a growth driver for your channel.

How Co-op Funds Are Different from MDF

Co-op funds and Market Development Funds (MDF) both support channel partners in executing marketing activities, but they differ in structure, purpose, and allocation. Understanding these differences helps businesses optimize their channel marketing programs effectively.

1. Funding Source & Allocation

- Co-op Funds: Generated as a percentage of a partner’s sales, typically accrued based on past performance. These funds are earned and must be used within a set period.

- MDF: Provided as discretionary funds by the brand or manufacturer to support strategic marketing initiatives. These are often pre-approved and do not require partners to earn them through sales.

2. Purpose & Flexibility

- Co-op Funds: Primarily used for demand-generation activities, such as digital ads, in-store promotions, and local sponsorships. A car manufacturer, for example, might allow dealers to use co-op funds strictly for local radio ads featuring their latest models.

- MDF: More flexible and can be used for broader market expansion efforts, including product launches, training programs, and competitive market penetration. A cybersecurity software company may offer MDF to select resellers to host industry webinars or attend major tech conferences.

3. Approval & Reimbursement

- Co-op Funds: Partners must submit claims with proof of marketing execution. Approval follows a structured reimbursement model.

- MDF: Usually pre-approved, meaning partners receive funding upfront based on a proposed marketing plan.

4. Who Qualifies?

- Co-op Funds: Available to all partners meeting minimum sales thresholds. The more they sell, the more they earn.

- MDF: Given selectively based on strategic alignment, market potential, or brand-specific priorities.

Co-op Funds vs. MDF: A Quick Comparison

Both funding models play a crucial role in supporting partner-driven marketing efforts. However, businesses must clearly communicate the differences to partners to avoid confusion and ensure funds are utilized effectively.

How Co-op Marketing Funds Work: The Basics

Co-op funds are typically provided by manufacturers or parent brands to support their channel partners’ marketing efforts. These funds help partners promote the brand’s products while reducing their own marketing costs.

Businesses allocate funds based on predefined structures, ensuring alignment with corporate marketing goals through effective co-op fund management.

Who Provides Co-op Marketing Funds and How Are They Distributed?

Manufacturers and distributors typically finance co-op advertising programs. The goal is to drive brand awareness and sales at the local level. Funds are distributed through direct reimbursements, accrual-based models, or pre-approved spending credits.

Some brands provide funds upfront, while others require partners to submit claims for reimbursement.

To access funds, partners must follow program guidelines. They may need to meet eligibility criteria, such as sales volume thresholds or specific marketing commitments.

Once approved, partners can use the funds for approved marketing activities.

Different Co-op Fund Models

Co-op fund distribution varies by business goals, partner performance, and industry standards. The three most common models include:

- Fixed Co-op Fund Allocation Model – Partners receive a set amount of funding, regardless of sales performance. This model ensures predictable channel partner funding but may not incentivize higher engagement.

- Percentage-Based Model – Funds are allocated as a percentage of a partner’s sales or purchase volume. Higher sales mean more available co-op dollars.

- Performance-Based Model – Funds are awarded based on marketing results, such as lead generation, conversions, or campaign engagement. This approach ties funding directly to measurable outcomes.

Some businesses combine these models to balance predictability and performance incentives. The right approach depends on partner engagement levels, industry dynamics, and corporate objectives.

Common Uses of Co-op Marketing Funds

Co-op funds support a wide range of marketing initiatives designed to increase brand visibility and local sales. Common uses include:

- Digital Advertising – Incorporating digital advertising strategies like paid search, display ads, social media campaigns, and programmatic advertising is essential. These channels drive online engagement and lead generation.

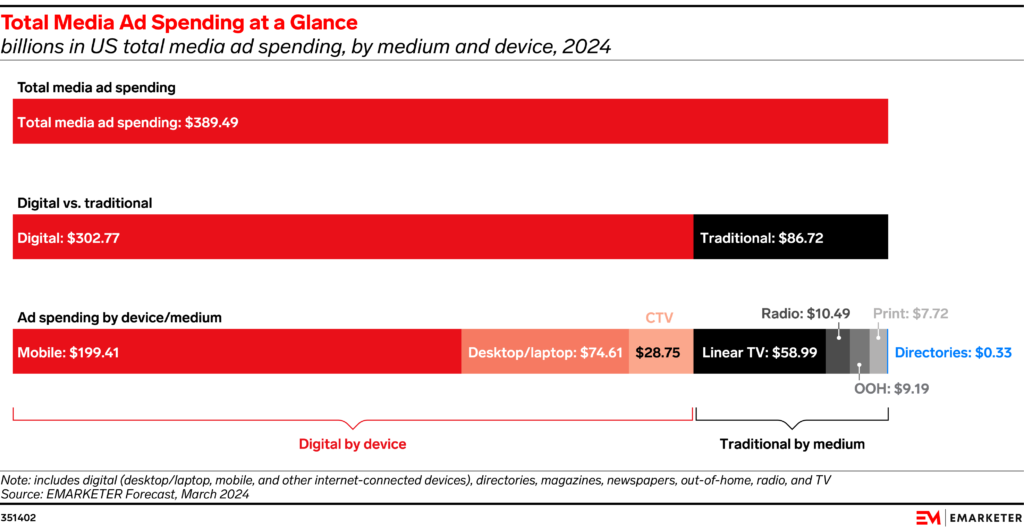

According to eMarketer, digital advertising now accounts for over three-quarters of total ad spend in the US. This shift reflects the growing prioritization of online channels by businesses. As brands allocate more co-op funds to digital, targeted paid campaigns can significantly enhance ROI.

- Traditional Advertising – Traditional advertising, including print ads, radio spots, and direct mail, targets local audiences and reinforces brand messaging. These channels build trust, especially in industries relying on offline sources.

Despite the rise of digital marketing, traditional media remains effective for reaching demographics that prefer physical or broadcast mediums. Integrating traditional and digital advertising ensures a well-rounded approach to brand visibility and customer outreach.

- Local Events & Sponsorships – Local events and sponsorships, like trade shows and community events, boost brand presence and customer engagement.

Sponsoring or participating strengthens relationships and drives word-of-mouth marketing. These events provide direct interaction with potential customers, allowing brands to showcase products, answer questions, and create memorable experiences. A strong local presence through events can increase brand recognition and long-term customer loyalty.

- In-Store Promotions – In-store promotions, such as branded signage and retail training, enhance customer experience and drive sales.

Well-placed displays and trained staff improve product visibility and influence purchases. Retail environments play a crucial role in converting interest into sales.Effective promotions ensure that customers receive the right information at the right time. Investing co-op marketing funds in staff training and eye-catching displays can significantly boost product uptake.

- Content Marketing – Content marketing, through co-branded blogs, videos, and emails, educates customers and increases engagement. Aligning messaging with partners builds authority and drives quality leads.

Well-crafted content enhances brand credibility. It also provides valuable insights that help customers make informed decisions. A strategic content approach with techniques like content atomization, SEO optimization, etc. ensures consistent communication across all marketing channels, strengthening both brand and partner relationships.

Partners can use their co-op marketing funds to hire content or digital marketing agencies for this approach.

Each co-op advertising program has specific guidelines on fund usage. Some programs require pre-approval for marketing activities, while others offer more flexibility. Proper tracking and reporting are essential to ensure compliance and measure effectiveness.

A well-structured co-op fund management program helps partners execute impactful marketing while maximizing ROI for the parent brand. The next section will explore best practices for allocating funds strategically.

Key Components of an Effective Co-op Fund Program

A successful co-op program isn’t just about making funds available—it requires structured co-op fund allocation, clear rules, and real-time tracking. Without these elements, funds often go unclaimed, are misused, or fail to generate measurable results. Here’s what makes a co-op advertising program effective.

1. Fund Allocation & Budgeting

Strategic MDF and co-op fund distribution ensures partners receive the right support while maintaining program sustainability. Businesses typically allocate funds based on partner tiers, sales performance, and historical fund usage.

High-performing partners or those in key markets often receive larger allocations. Some programs use a percentage-based model, where partners earn funds based on past sales. Others adopt a fixed co-op fund allocation approach, ensuring predictability but limiting flexibility.

Analyzing past fund usage helps forecast future needs. If certain partners consistently underutilize funds, businesses can reallocate budgets to more engaged participants. This prevents waste and ensures marketing dollars generate maximum impact.

2. Eligibility & Approval Processes

Not all partners automatically qualify for MDF or co-op marketing funds. Businesses set eligibility criteria to maintain program integrity and ensure funds support the most committed partners.

Qualification may depend on factors like sales volume, market reach, or previous participation in co-op programs. Some companies require partners to submit detailed marketing plans for approval before granting funds.

A complicated approval process can discourage participation. Many businesses now use automation to streamline approvals, enabling faster turnaround times and higher fund utilization.

3. Fund Usage Guidelines

Co-op marketing funds are a valuable resource for channel partners, but their effectiveness depends on proper utilization. These funds should support marketing activities that align with brand goals, increase local market visibility, and drive measurable sales impact.

Misuse or non-compliance can result in denied claims, lost channel partner funding opportunities, or strained partner relationships.

Eligible Marketing Activities

Digital Advertising

- Sponsored search campaigns on platforms like Google Ads and Bing Ads

- Paid social media promotions on LinkedIn, Facebook, and Instagram

- Targeted email campaigns featuring brand-approved promotions

- Display ads on relevant industry or consumer websites

Traditional Media

- Print advertisements in trade publications and local newspapers

- Direct mail initiatives using pre-approved brand materials

- Broadcast advertising, including radio spots and local TV commercials aligned with brand messaging

Local Sponsorships & Community Engagement

- Exhibitor booths at trade shows, industry expos, and networking events

- Sponsorships of local events that align with the brand’s target audience

- In-store experiential marketing, such as product showcases or live demonstrations

Retail & In-Store Marketing

- Branded signage, promotional displays, and point-of-sale materials

- Live product demonstrations to educate shoppers and drive engagement

- Training sessions for retail teams to ensure brand-aligned messaging and sales strategies

Restrictions & Compliance Policies

To maintain brand consistency and effective fund utilization, certain expenses are not eligible for co-op funding:

- Generic Advertising – Marketing efforts that promote a partner’s business without highlighting the brand.

- Operational Costs – Expenses such as rent, salaries, utilities, and general business overhead are not covered.

- Unauthorized Partners – Agencies, media outlets, or service providers must be brand-approved to qualify.

- Branding Violations – Marketing materials must adhere to brand guidelines, including correct logos, colors, and messaging.

Why Compliance Matters

Brands impose these restrictions to ensure consistent messaging, optimized spending, and stronger ROI. Partners who fail to comply may face funding delays, reduced allocations, or even disqualification from co-op programs.

4. Claims, Reimbursements & Auditing

A smooth reimbursement process encourages partners to use funds. If claims take too long or require excessive paperwork, partners may skip the opportunity altogether.

Businesses should offer a user-friendly claims portal where partners can submit proof-of-performance, such as invoices, ad reports, or campaign screenshots. Clearly defined requirements prevent back-and-forth communication delays.

Regular auditing is essential. It prevents misuse, ensures compliance, and helps businesses identify trends in fund utilization. Some companies use AI-powered tools to detect anomalies, flagging potential fraud before payouts occur.

5. Performance Measurement & Reporting

A co-op program’s success isn’t just about fund utilization—it’s about measurable impact. Businesses must track key performance indicators (KPIs) to assess effectiveness.

- Utilization Rate – The percentage of allocated funds that partners actually use.

- Marketing ROI – Sales or leads generated from co-op-funded campaigns.

- Engagement Metrics – Click-through rates, foot traffic, or customer inquiries tied to co-op initiatives.

A real-time reporting dashboard helps businesses and partners track progress, adjust strategies, and maximize returns. Without proper measurement, even a well-funded program risks inefficiency.

By combining smart allocation, clear processes, and data-driven insights, businesses can turn co-op marketing funds into a powerful growth tool. The next section will focus on practical strategies to improve fund utilization and partner participation.

Common Challenges in Co-op Fund Management & Solutions

Even well-funded co-op programs face obstacles that limit their effectiveness. Issues like underutilization, approval bottlenecks, compliance risks, and fraud can reduce the program’s impact. Recognizing these challenges and addressing them proactively helps businesses maximize fund ROI.

1. Low Fund Utilization Rates

Unclaimed co-op marketing funds are a common issue. Many partners either don’t know funds exist, find the process too complex, or feel restricted by rigid spending guidelines. If claiming funds requires too much effort, partners often skip the opportunity altogether.

Providing partners with real-time visibility into available funds, along with step-by-step application support, helps increase participation. Digital portals that simplify claims, along with faster reimbursements, encourage partners to use their allocated budgets effectively.

2. Complex Approval Processes & Delays

A slow, manual approval process discourages participation. If partners wait weeks for approvals, they may abandon co-op marketing altogether. Delays often result from outdated workflows that require multiple levels of review.

Shifting to an automated system speeds up approvals without sacrificing compliance. AI-driven workflows can pre-screen applications, flagging only those that need further review. A self-service partner portal that tracks status updates in real-time also reduces frustration.

3. Lack of Visibility & Transparency

When partners don’t know how much they’ve been allocated or how much remains, budgets go unused. Without a centralized system, brands also struggle to track spending, leading to misallocation and reporting errors.

A digital co-op management platform eliminates these issues by offering real-time tracking of fund availability, claims, and spending. Dashboards help brands and partners make informed decisions, ensuring budgets are fully utilized.

4. Compliance & Brand Consistency Issues

Not all partners follow brand guidelines when executing co-op-funded campaigns. Inconsistent messaging, outdated logos, and off-brand creatives weaken marketing efforts. Some partners may unintentionally violate branding rules due to unclear guidelines.

Providing pre-approved marketing templates and an easy-to-access digital asset management (DAM) system reduces errors. A creative review process before campaign launch ensures compliance while allowing partners enough flexibility to tailor marketing to their audience.

5. Fraud & Misuse of Co-op Funds

Fraudulent claims drain budgets and weaken trust in co-op advertising programs. Common tactics include inflated ad costs, duplicate claims, and using funds for non-approved expenses. Without proper oversight, businesses may lose millions in misallocated funds.

AI-powered fraud detection tools can spot irregular patterns, such as repeated claims for the same expense. Regular audits and strict documentation requirements add another layer of protection. Businesses that automate claim verification can prevent misuse while streamlining reimbursements for legitimate claims.

Addressing these challenges not only strengthens program integrity but also increases fund utilization. In the next section, we’ll explore best practices to maximize ROI and long-term program success.

How to Submit Co-op Claims

Submitting co-op claims can be a straightforward process if partners understand the requirements and follow the correct steps. A well-structured system ensures faster reimbursements and reduces claim rejections. Here’s how partners can successfully submit their claims.

Step 1: Gather Necessary Documentation

Partners must provide proof that co-op funds were used correctly. Required documentation typically includes:

- Proof of Performance – Screenshots of digital ads, copies of printed materials, or event photos showing brand promotion.

- Invoices and Receipts – Detailed invoices from vendors or media outlets verifying the cost of the marketing activity.

- Campaign Metrics (if required) – Engagement data, ad impressions, or other performance indicators, depending on program guidelines.

Missing or incomplete documentation is a common reason for claim rejection. To avoid delays, partners should review program requirements before submitting.

Step 2: Submit Claims Through a Digital Portal

Most co-op programs offer a submission portal where partners can upload documents and track claim status. Depending on the platform, partners may have two options:

- Manual Submission – Requires partners to enter claim details and upload supporting documents. Processing times can vary based on review complexity.

- Automated Submission – Some platforms integrate with marketing tools, automatically pulling performance data and invoices, reducing errors and speeding up approvals.

A user-friendly portal improves compliance by guiding partners through each step and flagging missing information before submission.

Step 3: Approval and Verification Process

Once submitted, claims go through a multi-step review:

- Initial Screening – The system checks for missing documents or incorrect entries.

- Program Compliance Review – Approvers verify that expenses align with co-op advertising program guidelines.

- Financial Validation – Accounting teams confirm invoice accuracy before final approval.

Some businesses use AI-driven verification to speed up approvals and detect anomalies, ensuring a smooth reimbursement process.

Step 4: Reimbursement Timelines and Common Reasons for Rejection

Reimbursement timelines vary by program, but partners can typically expect payments within 30 to 60 days after claim approval. Some companies offer expedited processing for preferred partners or high-priority claims.

Common reasons for claim rejection include:

- Incomplete Documentation – Missing invoices, proof of performance, or unclear details.

- Non-Compliance with Fund Guidelines – Expenses that don’t meet eligibility criteria.

- Late Submissions – Claims submitted after the deadline specified in the program terms.

To reduce rejections, businesses should provide clear submission guidelines, deadline reminders, and real-time tracking tools.

A well-structured claims process ensures faster reimbursements, increases partner satisfaction, and improves overall fund utilization. In the next section, we’ll discuss best practices for maximizing ROI from co-op marketing investments.

Best Practices for Optimizing Co-op Fund Management

A well-managed co-op fund program can drive stronger partner engagement, increase marketing reach, and generate higher ROI.

However, simply offering funds is not enough—businesses must actively manage, monitor, and refine their programs to ensure maximum effectiveness. The following best practices can help companies optimize their fund management strategies and get the most value from their investment.

1. Automate Co-op Fund Management Processes

Managing co-op funds manually is time-consuming, prone to errors, and creates unnecessary delays. Partners often face long approval times, unclear guidelines, and slow reimbursements, leading to frustration and underutilization of funds.

By adopting AI and automation in channel marketing, businesses can streamline processes, reduce administrative burden, and improve overall efficiency.

Automation can handle tasks such as co-op fund allocation, application review, and claim approval, significantly reducing turnaround times. It also ensures compliance by flagging non-eligible expenses before claims reach the approval stage.

Additionally, AI-driven fraud detection tools can analyze spending patterns to identify duplicate claims, inflated invoices, or misuse of funds, protecting the integrity of the program.

When co-op advertising programs operate smoothly and efficiently, partners are more likely to participate, leading to higher fund utilization and stronger marketing impact.

2. Provide Clear Guidelines & Training for Partners

One of the most common reasons co-op marketing funds go unused is that partners find the process complicated or confusing. Many businesses assume that partners fully understand the program, but without clear guidelines, partners may be unsure about eligibility criteria, fund usage restrictions, and reimbursement requirements.

Developing a co-op fund handbook that outlines step-by-step instructions for applying, using, and claiming funds helps eliminate confusion. This guide should include:

- Eligibility requirements – What qualifies a partner for co-op funds?

- Approved marketing activities – What expenses are allowed (e.g., digital advertising, local events, promotional materials)?

- Claim submission process – What documents are required, and how can they be submitted?

- Reimbursement timeline – How long does it take to receive funds after claim approval?

Beyond written documentation, businesses should invest in partner training. Hosting webinars, on-demand tutorials, and one-on-one support sessions can help partners navigate the program with ease. The more accessible and transparent the process, the more likely partners are to take full advantage of the funds.

3. Enhance Communication & Collaboration

A lack of clear communication between businesses and their channel partners often results in missed opportunities, delayed reimbursements, and underutilized funds. Partners need ongoing visibility into their allocated budgets, claim statuses, and marketing performance to make informed decisions.

Implementing a self-service partner portal can solve many of these issues. A well-designed portal allows partners to:

- Check their available funds in real-time

- Submit and track claims with status updates

- Access marketing resources, pre-approved templates, and compliance guidelines

- Receive notifications about fund expiration deadlines

Beyond digital tools, businesses should also provide dedicated support channels, such as live chat, email assistance, or assigned partner managers. When partners have easy access to help, they are more likely to stay engaged and use their funds effectively.

4. Use AI & Data Analytics for Smarter Fund Allocation

Traditionally, co-op fund allocation has been based on static models, such as a fixed percentage of sales or equal distribution across partners. However, this approach often leads to inefficient spending. Some partners may receive more funds than they need, while others lack enough to make an impact.

Using predictive analytics and AI-powered decision-making, businesses can distribute funds based on:

- Historical usage trends – Allocating more to partners who consistently use funds effectively.

- Sales performance – Rewarding top-performing partners with additional funds.

- Marketing impact data – Prioritizing partners with a strong track record of high ROI campaigns.

A data-driven approach ensures that MDF and co-op marketing funds are allocated where they will drive the greatest return. Additionally, real-time monitoring allows businesses to adjust fund distribution mid-cycle if certain partners are underutilizing their budgets.

5. Offer Incentives for High-Performing Partners

Co-op funds are meant to support all eligible partners. However, some partners consistently demonstrate better marketing execution, higher engagement, and stronger ROI. Rewarding these high-performing partners encourages continued participation and incentivizes others to improve their fund usage.

Businesses can introduce performance-based channel partner incentives, such as:

- Bonus fund allocations – Providing additional marketing dollars for partners who maximize their existing funds.

- Priority approvals – Offering expedited claim processing for partners who maintain compliance and efficiency.

- Exclusive marketing support – Giving top-tier partners access to premium marketing assets, strategic consultation, or co-branded campaigns.

Creating a tiered reward system ensures that partners are motivated to use their funds efficiently while reinforcing a culture of accountability and smart spending.

Leveraging Technology for Efficient Co-op Fund Management

Technology has transformed how businesses manage MDF and co-op funds, making the process more efficient, transparent, and scalable. Manual tracking through spreadsheets and emails creates inefficiencies, slows down approvals, and increases the risk of errors. To maximize fund utilization and partner engagement, businesses must invest in the right technology solutions.

From AI-driven fund allocation to self-service partner portals, modern tools ensure that co-op advertising programs run smoothly while delivering stronger ROI. Below, we explore the key technologies driving more efficient co-op fund management.

1. Why Every Channel Business Needs a Co-op Fund Management Platform

A dedicated co-op management platform is no longer a luxury. It’s a necessity for businesses that want to increase fund utilization, reduce administrative overhead, and improve partner experience. Without a centralized system, businesses struggle with slow approvals, lack of visibility, and underutilized budgets.

A robust co-op fund management platform should include:

- Automated fund allocation and approval workflows – Reducing manual processing time and eliminating bottlenecks.

- Real-time fund tracking and reporting – Allowing brands and partners to monitor available funds, submitted claims, and reimbursement statuses.

- Built-in compliance checks – Ensuring marketing spend aligns with program guidelines and brand requirements.

- Seamless integration with marketing tools – Connecting with CRM, advertising platforms, and analytics dashboards for better visibility.

By implementing a fully integrated co-op management solution, businesses can ensure that funds are allocated efficiently, claims are processed faster, and partners are more engaged.

2. AI and Predictive Analytics for Co-op Fund Optimization

Traditional co-op fund allocation follows a fixed-percentage model or historical sales performance. While this approach works to some extent, it fails to account for dynamic market conditions, partner engagement levels, and campaign effectiveness.

AI-powered co-op management solutions leverage predictive analytics to:

- Optimize fund distribution – AI analyzes historical data, sales trends, and campaign ROI to ensure funds go where they will drive the most impact.

- Identify underutilized funds early – Preventing budget waste by reallocating unused funds to high-performing partners before expiration.

- Detect anomalies and prevent fraud – AI flags suspicious claims, duplicate reimbursements, and potential misuse of funds.

- Automate decision-making – Speeding up approvals by validating claims against predefined rules and past spending patterns.

With AI-driven insights, brands can make data-backed decisions that enhance co-op program effectiveness and drive higher ROI on marketing investments.

3. OCR for Co-op Fund Management

Partners often struggle with manual data entry, lost paperwork, and delays in claim approvals. At Channel Fusion, we streamline this process with OCR (Optical Character Recognition) technology integrated into our co-op fund management platform.

OCR eliminates the need for manual uploads and data entry. It automatically extracts key information from invoices, receipts, and proof-of-performance documents. This reduces errors and accelerates approvals. It also ensures compliance with program guidelines.

- Eliminates manual data entry – OCR automatically extracts key details from invoices, receipts, and proof-of-performance documents, reducing human errors.

- Enhances compliance – Ensures claims meet program guidelines, minimizing the risk of rejections or compliance issues.

- Speeds up approvals – Automates claim verification, leading to faster reimbursements for partners.

- Boosts efficiency – Reduces administrative burdens, allowing partners to focus on executing high-impact marketing initiatives.

By leveraging OCR, partners can submit claims faster. At the same time, brands gain a more accurate and efficient claims verification process.

With OCR-powered automation, businesses can improve fund utilization rates and reduce administrative burdens. Instead of wasting time on claim corrections and resubmissions, partners can focus on executing high-impact marketing initiatives.

4. CLARA™: Real-Time Co-op Fund Guidelines & Support for Partners

One of the biggest challenges in co-op fund management is ensuring partners understand eligibility requirements, approved expenses, and claim submission rules. Misinterpretations often lead to rejected claims and unspent funds. Channel Fusion solves this issue with CLARA™ (Channel Liaison and Resource Agent), a smart support tool designed to make guideline access seamless.

With CLARA™, partners don’t need to sift through lengthy program documents. Instead, they can ask questions in real-time and receive instant, specific answers about co-op fund usage, branding requirements, and reimbursement policies. This reduces confusion and improves compliance, leading to fewer claim rejections and faster processing times.

- Instant guideline access – Partners can ask questions and get real-time answers about eligibility, branding, and reimbursement policies.

- Reduces claim rejections – Ensures partners submit accurate claims by eliminating confusion about approved expenses.

- Improves efficiency – Eliminates the need for lengthy email exchanges and document searches, speeding up the claim process.

- Enhances partner experience – Provides on-demand assistance, making it easier for partners to maximize their co-op fund usage.

CLARA™ enhances the partner experience by providing on-demand assistance, reducing back-and-forth communication, and ensuring co-op funds are used effectively. By making program guidelines more accessible, brands can increase partner participation and drive better marketing results.

5. Self-Service Partner Portals: The Key to Faster Co-op Fund Access

One of the biggest frustrations partners faces is delays in accessing co-op funds due to complicated submission processes and slow approvals. A self-service partner portal solves this by giving partners real-time access to fund information, claim tracking, and marketing resources.

A well-designed self-service co-op portal provides:

- Real-time fund balance updates – Partners can see available funds, claim history, and reimbursement timelines at a glance.

- Instant claim submissions – Digital submission forms with document upload options streamline the process.

- Approval status tracking – Partners receive automated updates on claim progress, reducing back-and-forth emails.

- Access to marketing assets and compliance guidelines – Ensuring that partners follow brand requirements without constant oversight.

With self-service portals, partners spend less time navigating bureaucracy and more time executing high-impact marketing campaigns.

Conclusion & Next Steps

Effective co-op fund management is essential for maximizing marketing impact, improving partner engagement, and ensuring every dollar spent delivers measurable returns.

Yet, many businesses struggle with fund underutilization, complex approval processes, and compliance challenges. A structured, technology-driven approach can eliminate inefficiencies and drive better results.

By implementing best practices—from automating fund allocation to enhancing transparency with self-service portals—channel businesses can ensure their co-op programs are efficient, scalable, and high-performing. In future, co-op management lies in AI-powered insights, predictive analytics, and real-time partner support, allowing brands to make data-driven decisions and optimize co-op fund usage.

Take the Next Step with Channel Fusion

If you’re ready to take your co-op fund management to the next level, it’s time to explore Channel Fusion’s advanced solutions. Our platform helps brands streamline fund distribution, automate approvals, and empower partners with real-time tracking and reporting.

Get in touch today to learn how our co-op fund management solutions can help your business increase ROI, improve partner engagement, and simplify program administration.