For tire manufacturers and automotive aftermarket parts and services companies, consumer rebates have long been a staple strategy to drive sales and incentivize consumer purchases. Leveraging the power of rebates, these companies aim to attract consumers, increase brand loyalty, and ultimately boost revenue. Amidst the rebate landscape, Channel Fusion stands out as a leading provider, specializing in managing consumer rebate programs for various industry leaders. Recently, as part of a comprehensive data research initiative, the Channel Fusion team unearthed valuable insights into the optimal timing and amounts for rebate programs, shedding light on key strategies for maximizing effectiveness and ROI.

Seasonal Trends: Timing is Key

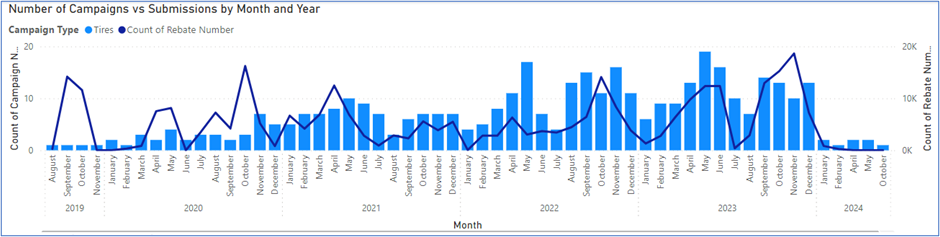

One of the key findings of Channel Fusion’s data research pertains to the optimal timing of consumer rebate programs. For tire manufacturer rebates, the analysis revealed a clear pattern: the highest ratio of rebate submissions to the number of rebate campaigns occurs during the fall months (September, October, and November) and the spring months (April and May). This trend underscores the importance of aligning rebate programs with seasonal fluctuations in consumer demand and purchasing behavior.

Conversely, for parts and service rebate programs, the data paints a more nuanced picture. Unlike tire manufacturer rebates, there is no singular optimal timeframe identified in the analyzed data. Instead, the highest ratio of rebate claim submissions to the number of rebate campaigns exhibits considerable variance across different periods of the year. As a result, for parts and service rebate programs, maintaining a consistent offering throughout the year emerges as the most effective strategy to yield optimal results.

Finding the Sweet Spot: Ideal Rebate Amounts

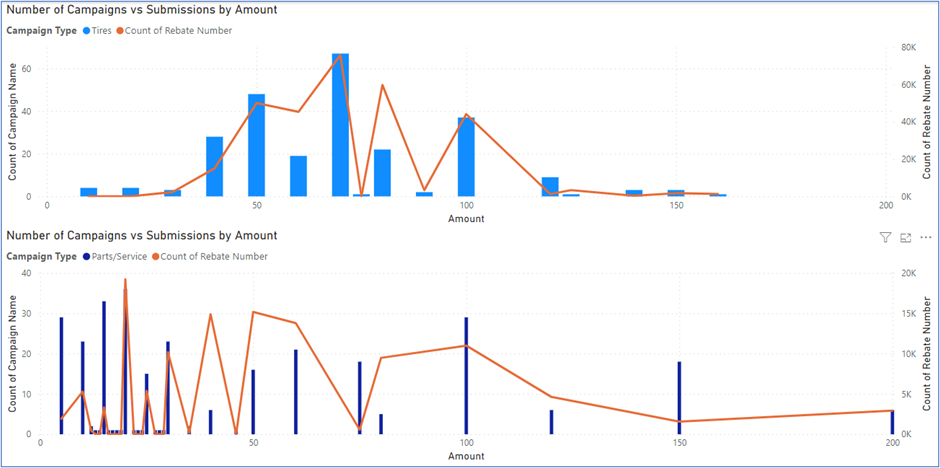

In addition to timing, Channel Fusion’s data research also delved into the ideal rebate amounts for maximizing consumer participation. For tire manufacturer rebates, the most common rebate amounts, in descending order, are $70, $50, and $100. However, it’s worth noting that the amount yielding the highest ratio of rebate claim submissions is $80. This insight highlights the importance of striking the right balance between rebate value and consumer incentive.

Similarly, for parts and service rebate programs, the analysis revealed distinct trends in rebate amounts. The rebate amounts vary based on the type of part or service being provided, including air filters, brakes, mechanical services, and oil changes and filters. The most common amounts are $20, followed by $15, $5, and $100. Interestingly, the highest ratio of rebate claim submissions to the number of claims occurs at the $40 and $50 rebate amounts, while the lowest submissions are observed at $75 and $150. These findings underscore the significance of tailoring rebate amounts to align with consumer preferences and perceptions of value.

Implications for Strategy: Leveraging Insights for Success

Armed with these insights, tire manufacturers and automotive aftermarket pa rts and services companies can fine-tune their consumer rebate strategies for maximum impact. By strategically aligning rebate programs with seasonal trends and offering competitive rebate amounts, companies can effectively drive consumer engagement, increase sales, and enhance brand loyalty.

For tire manufacturers, leveraging the fall and spring months as prime windows for rebate campaigns can capitalize on heightened consumer interest and purchasing activity. Additionally, setting rebate amounts in line with consumer preferences, such as the $80 sweet spot, can further incentivize participation and drive conversions.

Similarly, for parts and service rebate programs, maintaining a consistent offering throughout the year ensures sustained consumer engagement and maximizes ROI. By closely monitoring consumer response to different rebate amounts and adjusting strategies accordingly, companies can optimize their rebate programs for success.

Channel Fusion’s data research offers valuable insights into the intricacies of consumer rebate programs for tire manufacturers and automotive aftermarket parts and services companies. By leveraging these insights to refine their strategies, companies can effectively navigate the competitive landscape, drive sales, and foster lasting customer relationships. Ultimately, in an ever-evolving marketplace, data-driven approaches to consumer rebates are essential for staying ahead of the curve and achieving sustained success.

About Channel Fusion

For more than 20 years, Channel Fusion has been delivering strategy, customer experience and return on investment outcomes for brands and their channel partners with a wide variety of solutions and industry expertise. We continue to invest in the overall ecosystem of our channel marketing offering to ensure our clients can provide their channel partners with an optimal customer experience to drive results. Our core technologies and connected platform are supported by a team of customer-centric “Fusers.” Let us know if you’d like to learn more about how we deliver desired outcomes for brands and their channel partners.